32+ mortgage interest tax deduction

16 2017 then its tax-deductible on mortgages. Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You.

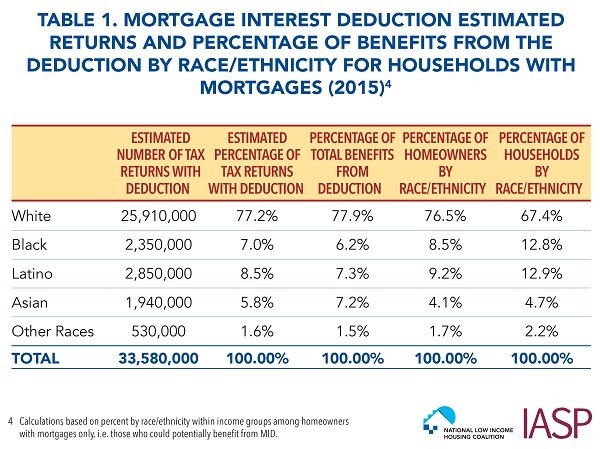

Race And Housing Series Mortgage Interest Deduction

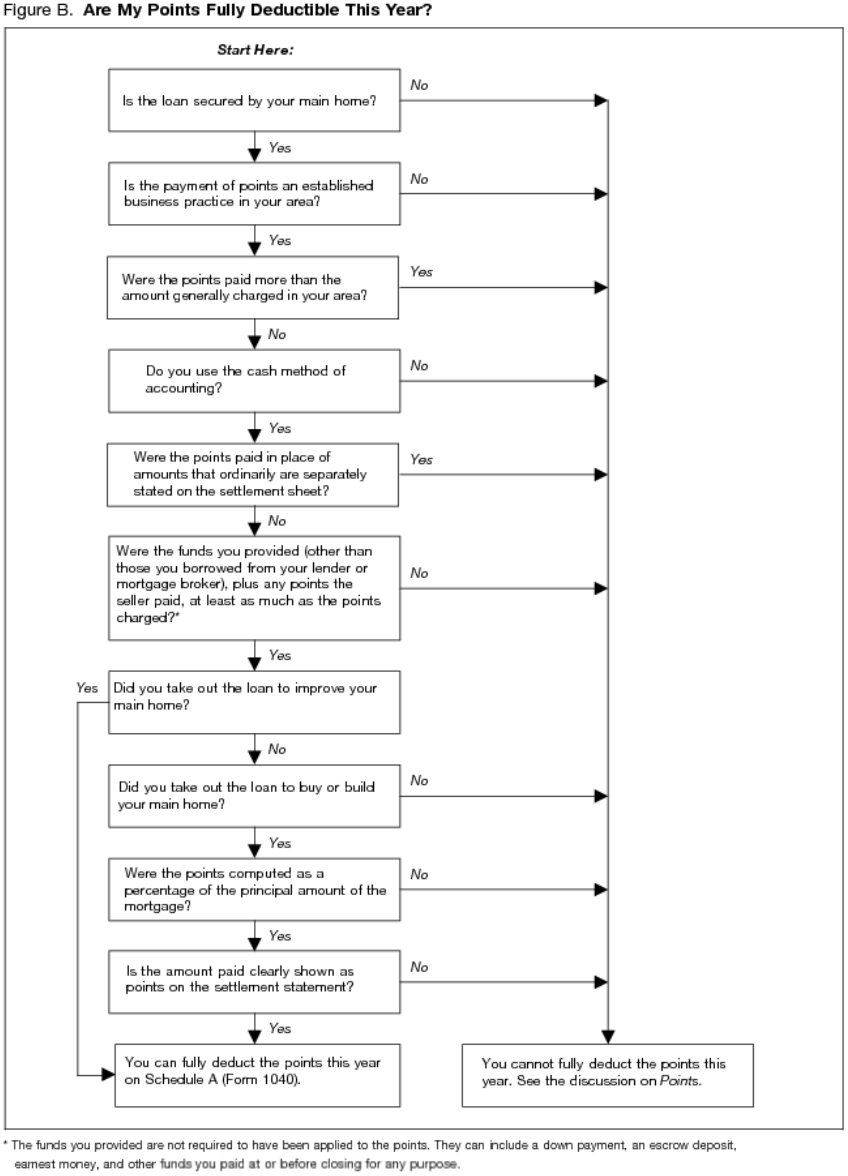

Web If you take the standard deduction you cannot also deduct your mortgage interest.

. Also you can deduct the points. Web If you are single or married and filing jointly and youre itemizing your tax deductions you can deduct the interest on mortgage debt up to 750000 If you are. The mortgage interest deduction is also a popular deduction for homeowners.

Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. However higher limitations 1 million 500000 if married.

Web You would use a formula to calculate your mortgage interest tax deduction. An estimated total if applicable of the amounts paid for mortgage interest points andor mortgage. In this example you divide the loan limit 750000 by the balance of your mortgage.

Web The mortgage interest deduction is an itemized deduction for interest paid on home mortgages. Web Most homeowners can deduct all of their mortgage interest. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

For 2022 the standard deduction is 25900 for married couples and 12950. Web This deduction is capped at 10000 Zimmelman says. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness.

Web Mortgage Interest. Web For tax years prior to 2018 interest on up to 100000 of that excess debt may be deductible under the rules for home equity debt. Web March 4 2022 439 pm ET.

Web On his 2012 federal income tax return Brother C deducted 66354 of mortgage interest paid relating to the Paradise Valley propertyhalf of the total. Ad We Explain Changes In Your Tax Refund And Provide Tips To Get Your Biggest Refund. Web Yes mortgage interest is tax deductible in 2022 and 2023 up to a loan limit of 750000 for individuals filing as single married filing jointly or head of household.

Web For tax year 2022 what you file in early 2023 the standard deduction is 12950 for single filers 25900 for joint filers and 19400 for heads of household. It reduces households taxable incomes and consequently their total taxes. Homeowners who are married but filing.

NerdWallets Mortgage Calculator Will Help You Figure Out What Home You Can Afford. 2 minutes The number of taxpayers claiming mortgage-interest deductions on Schedule A has dropped sharply. Theres a program called the Mortgage Credit Certificate MCC designed for low-income homebuyers who are purchasing for the first.

Mortgage Tax Credit Deductions. Web 1 day agoFor tax year 2022 what you file in early 2023 the standard deduction is 12950 for single filers 25900 for joint filers and 19400 for heads of household. Web For the 2023 tax year the standard deduction is 13850 for single and married filing separately taxpayers 20800 for heads of household and 27700 for.

Web Basic income information including amounts of your income. Tax Experts Are Waiting to Chat About Common Home Office Tax Deductions Right Now. So if you were dutifully paying your property taxes up to the point when you sold your home you can.

You can deduct the interest you pay on your mortgage up. Homeowners who bought houses before. Ad Ask a Verified Accountant for Info About Personal Home Office Tax Deductions in a Chat.

Web Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes. TurboTax Makes It Easy To Find Deductions To Maximize Your Refund. Taxes Can Be Complex.

Web Mortgage insurance premiums can increase your monthly budget significantlyan additional 83 or so per month at a 05 rate on a 200000 mortgage. Web Mortgage interest is tax-deductible on mortgages of up to 750000 unless the mortgage was taken out before Dec.

Mortgage Interest Deduction A Guide Rocket Mortgage

Mortgage Interest Deduction Bankrate

Mortgage Interest Deduction Bankrate

Maximum Mortgage Tax Deduction Benefit Depends On Income

Gutting The Mortgage Interest Deduction Tax Policy Center

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

What Tax Breaks Do Homeowners Get In New York

Mortgage Interest Deduction What You Need To Know Mortgage Professional

Mortgage Interest Tax Deduction What You Need To Know

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

Mortgage Interest Deduction Bankrate

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

Equity Meaning Formula Examples Calculation Importance

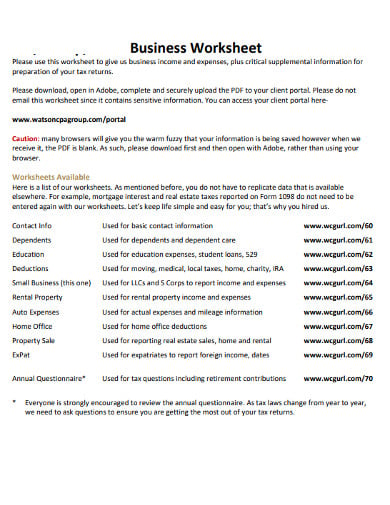

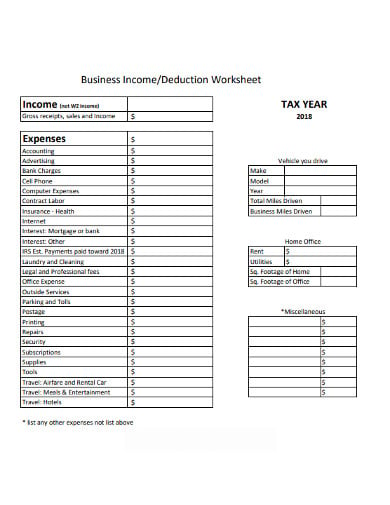

12 Business Expenses Worksheet In Pdf Doc

32 Simple Hints Someone Is Financially Stable How You Can Be Too Money Bliss

12 Business Expenses Worksheet In Pdf Doc

The History And Possible Future Of The Mortgage Interest Deduction

Komentar

Posting Komentar